|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Current Mortgage Lending Rates: A Comprehensive GuideThe mortgage market is a crucial component of the financial ecosystem, and staying updated on current mortgage lending rates can make a significant difference for potential homeowners and investors alike. This guide explores the latest trends, provides insights into different lending options, and addresses common questions. Key Factors Influencing Mortgage RatesMortgage rates are influenced by various factors, including economic conditions, government policies, and the overall demand for loans. Here are some critical considerations: Economic IndicatorsThe health of the economy plays a significant role in shaping mortgage rates. Inflation, unemployment rates, and the Gross Domestic Product (GDP) are primary indicators that lenders consider when setting rates. Federal Reserve PoliciesThe Federal Reserve's monetary policies, including changes in the federal funds rate, directly affect mortgage rates. A lower federal funds rate typically leads to lower mortgage rates. Comparing Popular Mortgage OptionsChoosing the right mortgage option depends on individual financial situations and future plans. Below are some common types of mortgages:

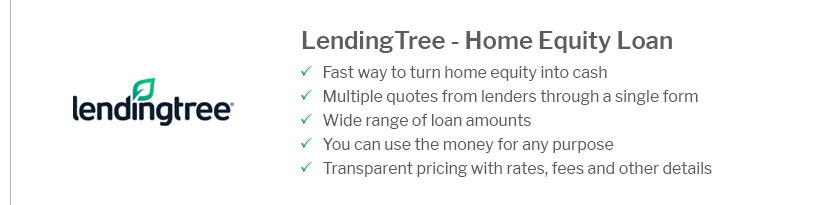

For those considering refinancing options, understanding the refinance your home meaning can provide valuable insights into whether it's a suitable choice for reducing your interest rate or changing your loan term. Steps to Secure the Best Mortgage Rate

For those thinking 'I want home loan' and looking to start the process, it's crucial to assess your financial situation and be prepared with the necessary documentation. Frequently Asked QuestionsWhat is the current average mortgage rate?The average mortgage rate varies daily and is influenced by market conditions. As of now, it's essential to check with local lenders for the most accurate rates. How can I lock in a low mortgage rate?To lock in a low rate, consider monitoring the market closely, improving your credit score, and acting swiftly when rates dip to a desirable level. Are mortgage rates expected to rise or fall?Predicting future mortgage rates is challenging as they are influenced by various factors, including economic trends and government policies. It's advisable to stay informed through financial news and consult with experts. In conclusion, understanding the factors affecting current mortgage lending rates and knowing how to navigate different mortgage options can empower you to make informed financial decisions. Whether you're looking to refinance or secure a new loan, staying informed is your best strategy. https://www.uwcu.org/rates/mortgage-purchase

Current Rates ; 30 Year Fixed Rate** - $6.40 - 6.625% ; 15 Year Fixed Rate** - $8.51 - 6.125% ; 5yr/6mo ARM** - $6.16 - 6.250% ; Home Construction Loans** - $4.90 - 5.875% ... https://www.totalmortgage.com/mortgage-rates

Compare today's mortgage rates. The current mortgage rates are as low as 6.000% for a 30-year fixed mortgage as of March 26 2025 4:15pm EST.

|

|---|